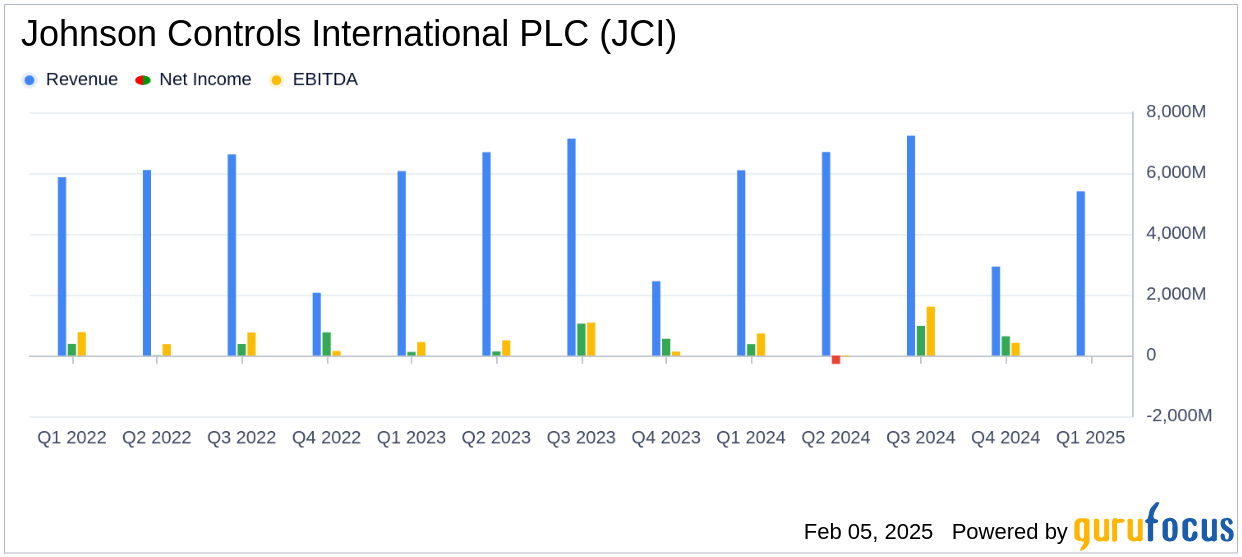

On February 5, 2025, Johnson Controls International PLC (JCI, Financial) released his 8-K filing with the yield of the financial year in the first quarter. The company, a worldwide leading provider of intelligent, healthy and sustainable construction solutions, reported a GAAP -EPS of USD 0.55 and an adjusted EPS of 0.64 US dollars, with both not dropping the analyst estimate of $ 0.74 . The turnover for the quarter was 5.4 billion US dollars, which also missed the estimated $ 5,665.51 million.

Company overview

Johnson Controls Controls Manufactures, Installation and Services HLK systems, building management systems and controls, industrial cooling units as well as fire and safety solutions. In the 2023 financial year, the company generated sales of almost 27 billion US dollars, with over 45%of sales, fire and security made around 40%and HLK, industrial cooling and other solutions that made the remaining 15%.

Performance highlights and challenges

Despite the profit, Johnson Controls reported to an increase in sales by 4% and sales growth of 10% compared to the previous year. The company also recorded an organic increase in orders by 16% and an organic increase in the residue of construction solutions by 11% of a total of 13.2 billion US dollars. These numbers underline the robust demand and the strategic positioning of the company in the market for construction solutions.

However, the lack of EPS and income compared to analyst estimates show potential challenges in cost management and market conditions. The company's ability to master these challenges will be decisive in order to maintain the trust of investors and to achieve its increased state instructions.

Financial successes and industrial importance

The financial achievements of Johnson Controls, such as organic sales growth of 10% and the significant increase in the backlog, are of crucial importance for its role in the construction industry. These metrics indicate a strong market demand and an effective implementation of their strategic initiatives, which are of essential importance to maintain long -term growth and competitiveness.

Important financial metrics

The company's GAAP income from continued business was $ 363 million, while adjusted income from continued business activities was 426 million dollars. Cash that was supplied by operating activities was 249 million US dollars, with the Free Cashflow being adjusted at $ 133 million and an adjusted free cash flow at $ 603 million. These metrics are crucial for the evaluation of the company's operational efficiency and liquidity.

Segment performance

| segment | Sales (2025) | Sales (2024) | Change | Segment EBITA Marge (2025) | Segment -bita margin (2024) | Change |

|---|---|---|---|---|---|---|

| Construction solutions of North America | 2,744 million US dollars | 2,487 million US dollars | 10% | 12.1% | 11.5% | 60 BP |

| Construction solutions EMEA/LA | 1,073 million US dollars | 1,038 million US dollars | 3% | 10.1% | 7.7% | 240 BP |

| Building solutions in the Asian -Pacific space | 527 million US dollars | $ 507 million | 4% | 9.3% | 9.1% | 20 BP |

Analysis and outlook

The performance of Johnson Controls in Q1 reflects the strategic focus on organic growth and operational efficiency. The company's ability to increase its gap and order organically is a positive indicator of future sources of income. However, the estimates for missed profits and income indicate that the company must meet the cost pressure and market volatility to the financial goals.

With a view to the future, Johnson Controls has increased his instructions for 2025 for 2025 and expects that medium-sized sales growth will be adjusted with medium settings and an adjusted EPS of $ 3.50 to $ 3.60. This optimistic outlook could, if reached, improve the shareholder value and consolidate the management of the company in the industry for construction solutions.

Discover the full 8 k Gem Gempts (here) by Johnson Controls International PLC for further details.