Key Takeaways

- Hon exceeded the industry with 10% growth, led by Aerospace, the growth of automation and energy solutions.

- The deficit rose by 10% to USD 36.6 billion; 2025 sales of 40.8 to $ 41.3 billion with $ 4-5% organic growth.

- High debts, rising interest costs and weakness in industrial automation put a strain on the short -term prospects.

Shares of Honeywell International Inc. ((Hon – – Free report) have shown some decent profits lately and increased by 10% last year. The industrial conglomerate has exceeded the growth of the industry of 2.5%. In contrast, the company's colleagues, Carlisle Companies incorporated ((CSL – – Free report), Zebra Technologies Corporation ((Zbra – – Free report) and MSA Safety Incorporated ((MSA – – Free report) have 4.5%, 0.8%or. 1.5%lost. However, it was 20.5%behind the increase in the S&P 500 Composite.

The price performance of the Hon share

Image source: Zacks Investment Research

The share closes at $ 216.37 on Friday and acts below its 52-week high of USD 242.77, but much higher than its 52-week low of $ 179.36.

Factors that drive Honeywell's performance forward

Honeywell has a persistent strength in his commercial aviation aftermarket business, which is due to solid demand on the air traffic market and the improvement of the supply chain. In the second quarter of 2025, sales from the business with commercial aviation -Abaftermarket business rose by 7%compared to the previous year. The strength of the defense and space business due to stable US and international defense volumes and a continuing demand from the current geopolitical climate is also advantageous. In the second quarter, sales from defense and space business increased by 13%compared to the previous year.

In the upcoming quarters, Hon expects the segment of aerospace technologies to benefit from strong demand in commercial aviation, the growth of air traffic times, higher ship examination and strong defense volume.

The solid demand for products and solutions, led by increasing construction projects, especially in North America, the Middle East and India, is expected to advance the building automation segment. The increasing order rates in data centers, airports and hospitality projects are good for this.

A solid dynamic in the business business for universal oil products that are powered by projects with higher refinement and petrochemicals is favorable for the segment for energy and sustainability solutions. The company's total jam rose by 10% to 36.6 billion US dollars in the second quarter compared to the previous year. For 2025, the total revenue in the range from 40.8 to $ 41.3 billion is expected. The organic income is expected to increase by 4-5% compared to the previous year.

Honeywell's commitment to reward his shareholders through dividends and stock returns is also encouraging. In the first six months of 2025, it paid dividends worth 1.48 billion US dollars and bought back shares worth 3.6 billion US dollars in September 2024. In September 2024, HON also increased its quarterly dividend by about 5% to $ 1.13 per share.

The company's ability to generate a strong free cash flow supports its shareholder -friendly activities. Hon expects the free cash flow for 2025 in the range of $ 5.4 to $ 5.8 billion.

There are only a few short -term concerns

The softness in the business with productivity solutions and services due to the Project Running remains the segment of industrial automation. In the second quarter of 2025, the sales of the segment decreased by 5% compared to the previous year. For 2025, it assumes that the organic turnover of the industrial automation segment in the area of low to medium inputs will decrease.

High long -term debts is still very important for Honeywell. Long-term debts in the past five years (2020-2024) have increased by 9.3% (CAGR). The long-term debts of Hon in the second quarter of 2025 amounted to $ 30.2 billion and over $ 25.5 billion at the end of 2024. The increase in debt level was primarily due to the funds collected for acquisitions. In view of its high level of debt, the cash and cash equivalents of 10.3 billion US dollars are not impressive.

In addition, interest costs and other financial costs were a high company at $ 330 million in the second quarter of 2025, which corresponds to an increase of 32% compared to the previous year. A high level of debt can increase its financial obligations and disadvantage for profitability.

Stock assessment

Honeywell is currently dealing with a 12-month KG/E of 19.63x with a bonus compared to 16.33 times in the industry. While his peer, Carlisle, acts compared to Hon cheaper, Zebra technologies and MSA security are traded into a premium. Remarkably, Carlisle, Zebra Technologies and MSA security are currently traded at 15.69x, 19.89x or 20.65x.

Price-performance ratio (12 months forward)

Image source: Zacks Investment Research

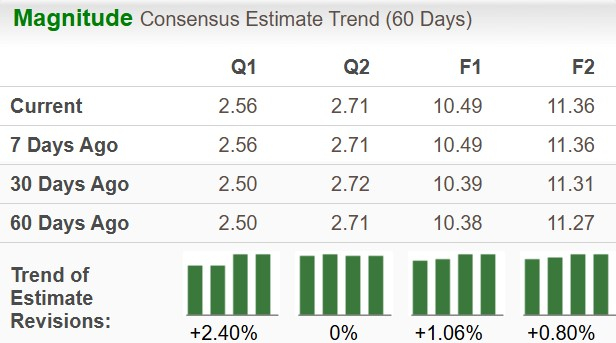

Hons earnings estimate revision

The Zacks Consensus estimate for the result of Honeywell 2025 has increased by 1.1% to $ 10.49 per share in the last 60 days, which indicates growth of 6.1% compared to the previous year. The consensus mark for 2026 profits rose by 0.8% to $ 11.36 per share, which indicates an increase of 8.2% compared to the previous year.

Image source: Zacks Investment Research

Last attitude to Honeywell

Despite its several board members and impressive dividend distribution trends, the short -term challenges, such as the continued weakness in the industrial automation unit and high level of debt, limit the short -term prospects of this Zack 3rd (hold). While the current shareholders should hold their positions, new investors should wait for the stock to withdraw some of its latest profits and achieve a better starting point.

You can see The full list of today's Zacks #1 rank (Strong Buy) protocols here.