The chances are good that you have recently visited one of these two retailers …

Regardless of whether you need electric tools, a new refrigerator or even plants and earth for your garden, Home Depot (HD) and Lowe (low), you have covered.

These two companies dominate the market for home improvements … and compete for the largest piece of the cake.

Every company wants to grow faster and make more profits. It is a natural rivalry.

Home Depot has 2,350 shops. It has gained an advantage with the professional contractor … about 50% of his sales come from professionals.

Lowe's, on the other hand, has about 1,750 shops. And historically, it has focused on the customer of the do-it-yourself (“DIY”)-and this group accounts for about 70% of sales.

Personally, I just go to the business that was closest to me at the time. But investors have a more difficult choice to make …

Home Depot and Lowe's have been both amazing capital connectors over the years. Both companies are also impressive dividend payers.

Fortunately, we have an insight into the share that is the better purchase.

Both retailers for do -it -yourselfers reported in the second quarter in the last few days. Let us go through the results and see which stock looks more attractive …

Investors liked the profit for both do -it -yourselfers shares

Home Depot reported profits on Tuesday. It wasn't the best quarter on the surface …

The turnover was 45.3 billion US dollars and the net profit of 4.6 billion US dollars -both below expectations. But the market didn't seem to complain about the “Miss”. In fact, the Home Depot shares rose by more than 3%a day.

Investors liked that Home Depot kept his instructions for the financial year, although consumers are careful today. The company has also published other encouraging numbers …

The turnover with the same business (a key metric for retailers) was positive for the first time in two years, an increase of 1% compared to the previous year. And transactions over $ 1,000 increased by 2.6%compared to the previous year.

Lowe published his income this morning. It made a touch better than Home Depot …

The turnover was 23.9 billion US dollars for the quarter – according to expectations. The net win was 2.4 billion US dollars, which was higher than expected. Management also increased its sales for the entire year.

However, the great news for Lowe's was the announcement of an 8.8 billion dollar offer for the purchase of building blocks for foundations … a company that distributes construction products such as drywall, metal frame and insulation.

This is important because the basics of the basis are mainly sold to large residential and commercial customers. Again, Lowe's Home Depot has behind the professional market. But it takes steps to attract more companies from experts.

Marvin Ellison, managing director of Lowe, says that the professional market has an overall addressable market of 250 billion US dollars.

Home Depot also made acquisitions-at the beginning of this summer for $ 5.5 billion for $ 5.5 billion. But with this deal, Lowe's the ground.

The market loved the announcement. Lowe's stock rose around 4%outdoors.

Home Depot and Lowe's are in a race to win the largest market share between DIY and PRO customers.

Fortunately, some drivers in the industry should help both Company – also in an uncertain environment …

A win-win market for DIY projects

First, houses in the United States are almost old.

According to the latest data, the average age of the owner bundle houses is 40 years.

Older houses need more renovation work and maintenance. These are good news for Home Depot and Lowes … It means more roof replacement, HLK upgrades, repairs of installations, electrical work and kitchen conversions.

Second, high mortgage lenses keep families included in “their houses”.

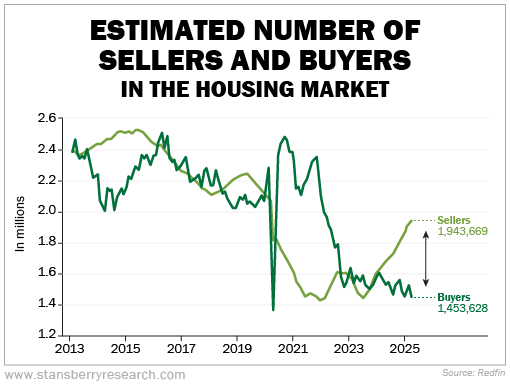

The following table comes from online real estate agent. It shows the estimated number of buyers and sellers on the real estate market in the past ten years. As you can see, there were much more buyers than sellers in 2020 and 2021.

But from June we will see many other sellers on the market – almost 500,000 that are specific. Just look …

Many families were included in low mortgage lenses during pandemic. You do not want to exchange this attractive rate for a higher trade today.

This interest rate setup is equipped with advantages and disadvantages …

On the one hand, people will remain tend to remain and repair their current houses. This is a thrust for the DIY segment.

On the other hand, due to higher credit costs, you can also move larger projects to renovate budgets. And low living sales could mean less renovation for the market – which the pro segment can harm a little.

Fortunately, prices should fall in the next few months. The market relies on it. According to the Prediction Market Polymarket, the probability of the Federal Reserve Cuts interest rates in September are more than 70%.

If the interest rates of the FED sinking mortgage lenses bring it-it could be a win-win situation …

If the real estate market builds up, we will see more sellers, build up the houses to attract buyers … and more buyers who repair houses they have just bought. The pro segment will share more of the advantages.

Of course, lower prices give trust to open their wallets – and to spend more for Home Depot and Lowe.

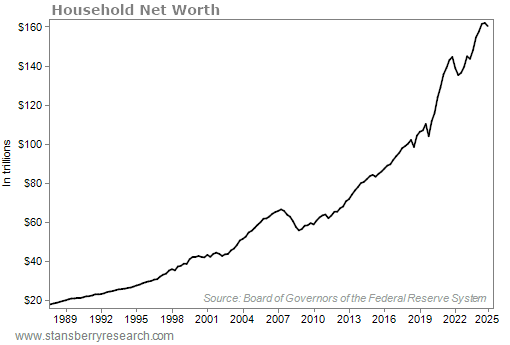

That brings us to the third driver … close records of household assets.

Most families receive their net assets from their house value or from the stock exchange. And both real estate prices and the S&P 500 index are near record highs. Since 2019 alone, the properties of equity have increased by 50%.

This gives many home owners a lot of money to finance their home improvement projects. And that's before Changes to the interest rates.

The catch is that there is a lot of uncertainty in the economy today. But today's setup is optimistic about the home improvement sector.

Add everything and the entire market for home improvements in the USA is expected to grow by 3.5% in 2026.

By 2029, the market should reach massively 688 billion US dollars. And according to the Home Improvement Research Institute, consumer expenditure will drive about two thirds of this growth.

Home Depot and Lowe's will continue to fight him – and see which retailers can win the largest market share.

The best dividend stock for today's real estate market

As I already mentioned, both Home Depot and Lowes were fantastic stocks to …

Home Depot has returned almost 1,500% to shareholders (invested with dividends) in the past two decades. That is a massive 14.8% per year.

Lowe's is in the successor, but only slightly. It has an overall return of 970% over this route or 12.6% per year.

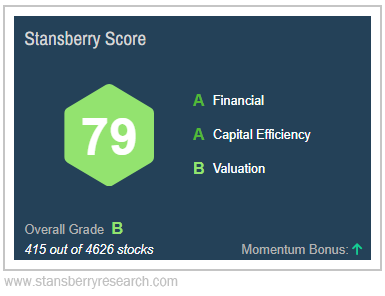

According to our proprietary Stansberry score, this trend could soon turn back … although Lowe took the lead.

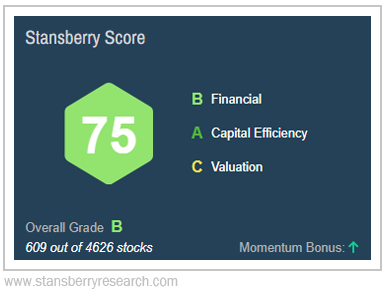

Home Depot receives a Stansberry score of 75 with a B grade for financial data, A for capital efficiency (Hallmark metric metric of the Stansberry research) and a C for the evaluation.

This is a good score. On the other hand, the grades of Lowe are better and receive AA for financial data and capital efficiency and off for the evaluation …

One thing that Lowe helps today is his dividend story …

Home Depot has increased its annual dividend payment for 16 consecutive years. Lowe's has increased it for 60 consecutive years and deserves the rare title “Dividend King”.

It is also important that Lowe's has a cheap “dividend distribution rate”. It only pays 39% of the profit for its dividend … while Home Depot has a “dividend distribution rate” of 66%.

This means that Lowe's is in a better place to further increase its dividend in the future.

In order to be clear, both retailers for do -it -yourselfers should be attractive for income investors. I do not think that a company is exposed to the risk of reducing their dividend. But Lowe's has a light edge (and a better overall dividend -success balance sheet).

In the end, both shares look promising according to the latest income. But our Stansberry Score believes that Lowe's is the better bet.

Simply note … with lower rating levels on both shares, you should keep them on your observation list for the time being. You may get a better investment structure if you can buy when you dive.

Invest well,

Jeff Havenstein