This is just an insight into the data that Civicscience customers are available. Find more data.

Devices can be a significant investment, and the early summer is often an ideal time for the purchase thanks to the sales events on July 4th. The working day also brings another wave of shops in the season. But this year tariffs and wider economic uncertainty could bring a wrench into the purchase plans of the American device. Where is the purchase of devices today and who plans to make a purchase? Civicscience has the latest view.

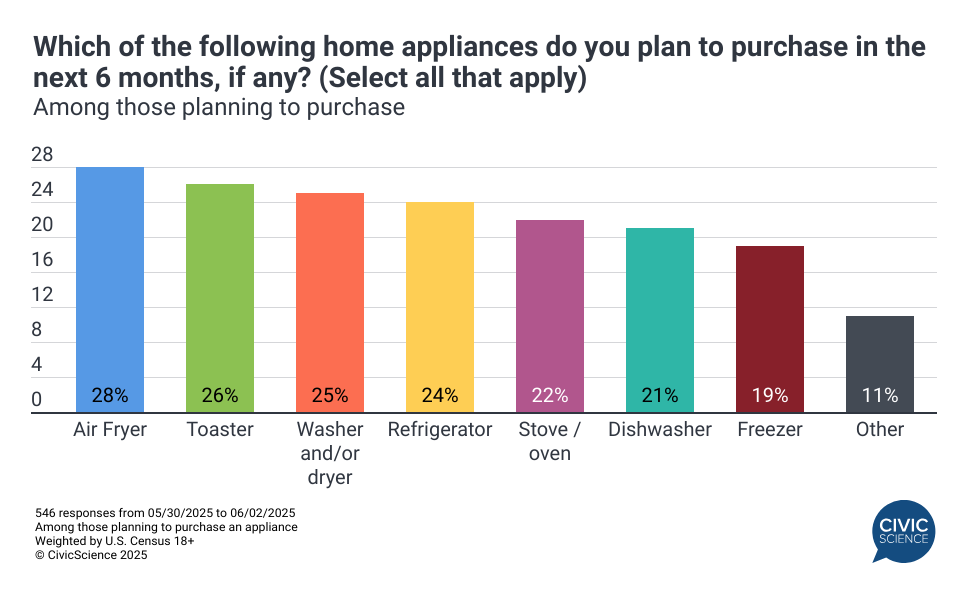

New Civicscience data find that about two out of five Americans are planning to buy at least one of the following devices in the next six months. Air fryers are most common in the case of likely future purchases, followed by toasters, washers and/or dryers and refrigerators. Those who want to buy a device in the near future are the most likely gen z (18 to 29 years), Democrats, have an expected annual household income below $ $ 100,000 and live in the southern USA

Take in our survey: Do you usually wait until the sale of holiday weekends to buy high -priced articles such as technology or devices?

The replacement for many device owners

Additional surveys from Civicscience show that 38% of the US -growing people currently have at least one device that you have to replace within the next six months, including 12%, which expect to replace more than one. It is not surprising that these percentages among those who want to acquire a device over the next six months will consider considerably – 73% of them assume that they expect the need to replace at least one, and 26% expect that they have to replace more than one.

How the purchase of devices notices

How do those who want to buy a device in the next six months differ from those who don't want to buy? Additional data from citizenship show that those who want to buy a device in the next six months are:

- Almost 30 percentage points are more likely than non-intenders to drink beer (21+ in adults).

- 54% state that they will at least use something “something” and pay later services for the purchase of food in the next six months (among those who buy food).

- More than 3 times as well as those who do not plan a purchase to say that they will probably also change cable or satellite providers in the next 90 days.

- More than 5x is planning a remodel in the kitchen in the next 12 months.

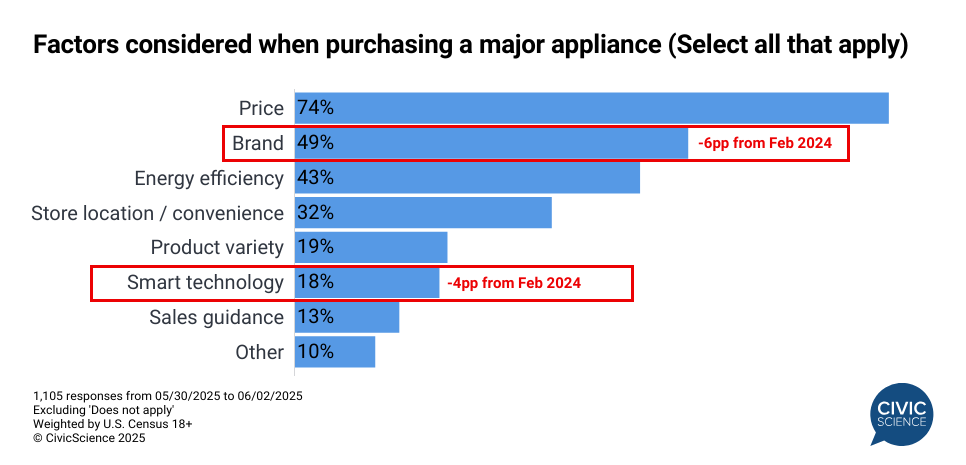

Fewer device buyers take into account brand and smart technology

If consumers rate the purchase of devices, “price” is not surprisingly the leading factor that is taken into account by a large margin. While most other considerations have hardly been changed since February 2024, the percentage of consumers who prioritize the “brand” and “Smart Technology” brand has decreased by six or four percentage points. Despite this decline, however, the second most frequent consideration.

Use this data: Civilcience customers use such real-time data as this to identify changing buying drivers, uncover conquest options and adapt messages, build loyalty and win new customers.

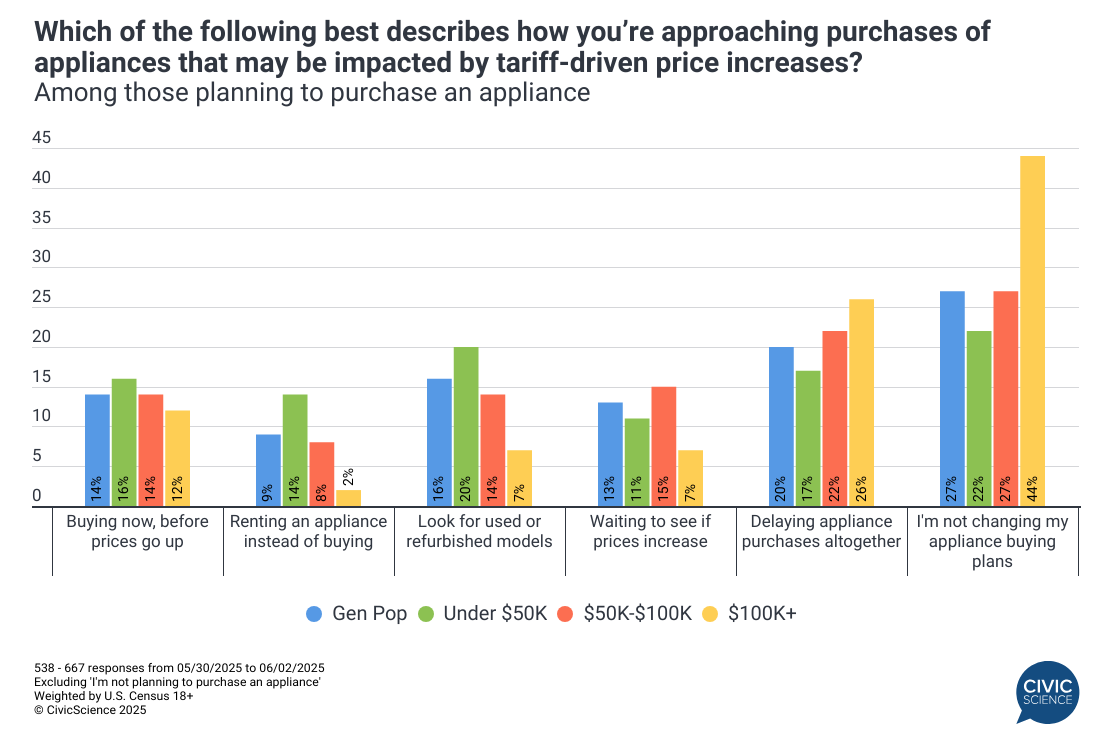

Used and rental options are appealed if the buyers of devices adapt the plans to the uncertainty

The economic uncertainty is heavily burdened by the buyers of devices, and almost three out of four buyers stated that their plans were influenced in any way. Overall, more (20%) is delayed than accelerating purchases in order to exceed potential price increases (14%). In addition, a little more than a quarter turn to alternatives, e.g.

Households with a high income ($ 100,000) are most likely to say that their plans will remain unchanged, but they also lead to delaying purchases. Households with low income (less than $ 50,000) are the most open for used or renovated models and accelerate their purchases a little more often. Households with medium-sized incomes via index at a “waiting-and-see” approach.

Enter the conversation: How positive or negative are you overall about the idea of having everyday household appliances (refrigerator, washing machine, etc.) connected to the Internet?

With the summer sales on the horizon, device brands and retailers can still see solid demand, but they have to meet consumers where they are: price -conscious, unsafe and open to alternatives. How you react could not only shape sales of this season, but also the long-term shifts in the way Americans buy for big-ticket home essentials.