HighTower Advisors LLC reduced its stake in shares of ADT Inc. (NYSE:ADT – Free Report) by 14.6% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 27,899 shares of the security and automation company after selling 4,774 shares during the quarter. HighTower Advisors LLC's shares of ADT were worth $199,000 at the end of the last quarter.

HighTower Advisors LLC reduced its stake in shares of ADT Inc. (NYSE:ADT – Free Report) by 14.6% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 27,899 shares of the security and automation company after selling 4,774 shares during the quarter. HighTower Advisors LLC's shares of ADT were worth $199,000 at the end of the last quarter.

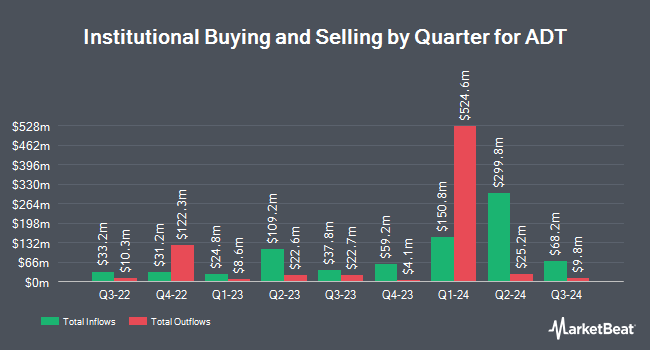

Several other hedge funds and other institutional investors have also recently bought and sold shares of the stock. Pacer Advisors Inc. acquired a new position in shares of ADT during the 2nd quarter valued at $195,461,000. LSV Asset Management increased its position in ADT by 186.0% in the second quarter. LSV Asset Management now owns 9,646,113 shares of the security and automation company's stock worth $73,310,000 after purchasing an additional 6,272,974 shares in the last quarter. Dimensional Fund Advisors LP increased its holdings in shares of ADT by 61.5% in the second quarter. Dimensional Fund Advisors LP now owns 12,359,752 shares of the security and automation company's stock valued at $93,937,000 after purchasing an additional 4,705,544 shares during the period. AQR Capital Management LLC increased its holdings in shares of ADT by 75.0% in the second quarter. AQR Capital Management LLC now owns 7,862,453 shares of the security and automation company's stock valued at $59,755,000 after purchasing an additional 3,370,550 shares during the period. Finally, Ariel Investments LLC increased its position in shares of ADT by 2.6% in the 2nd quarter. Ariel Investments LLC now owns 30,360,559 shares of the security and automation company's stock valued at $230,740,000 after purchasing an additional 780,762 shares in the last quarter. 87.22% of the shares are owned by institutional investors and hedge funds.

ADT trading up 1.0%

ADT shares opened at $6.87 on Thursday. The company has a market cap of $6.23 billion, a P/E ratio of 7.47 and a beta of 1.49. The company has a 50-day moving average price of $7.38 and a 200-day moving average price of $7.34. The company has a debt-to-equity ratio of 1.93, a short-term ratio of 0.64 and a current ratio of 0.81. ADT Inc. has a 52-week low of $6.02 and a 52-week high of $8.25.

ADT (NYSE:ADT – Get Free Report) last released its quarterly earnings data on Thursday, October 24th. The security and automation business reported $0.20 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.17 by $0.03. The company had revenue of $1.24 billion for the quarter, compared to analysts' expectations of $1.22 billion. ADT achieved a return on equity of 17.77% and a net margin of 18.18%. ADT's revenue increased 5.4% compared to the same quarter last year. In the same quarter last year, the company had earnings per share of $0.07. Sell-side analysts expect that ADT Inc. will report EPS of 0.7 for the current fiscal year.

ADT dividend announcement

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, January 9th. Investors of record on Thursday, December 12th will be given a dividend of $0.055 per share. This equates to a dividend of $0.22 annualized and a yield of 3.20%. The ex-dividend date is Thursday, December 12th. ADT's payout ratio is currently 23.91%.

Analyst upgrades and downgrades

Several stock analysts have commented on the stock. Morgan Stanley increased their price target on shares of ADT from $8.50 to $9.00 and gave the company an “equal weight” rating in a report on Thursday, December 12th. Royal Bank of Canada raised their price objective on shares of ADT from $8.00 to $9.00 and gave the stock a “sector perform” rating in a research report on Friday, October 25th. Finally, Goldman Sachs Group raised their price target on shares of ADT from $8.20 to $9.20 and gave the company a “buy” rating in a research report on Friday, October 25th.

Get our latest report on ADT

ADT company profile

(Free Report)

ADT Inc provides security, interactive and smart home solutions to consumers and small businesses in the United States. The company operates in two segments: Consumer and Small Business and Solar. The company offers burglar and life security alarms, smart security cameras, smart home automation systems and video surveillance systems.

Recommended Stories

Want to see what other hedge funds are holding ADT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for ADT Inc. (NYSE:ADT – Free Report).

Get news and reviews for ADT Daily – Enter your email address below to receive a concise daily summary of the latest news and analyst ratings for ADT and related companies with MarketBeat.com's FREE daily email newsletter.