Cary, NC (WTVD) – A triangle roof binding company says that it is more than 100,000 US dollars, and the homeowners who hired them could be on their hooks, even though their insurance company has already paid for the work.

The case includes a middleman who is generally referred to as a public setting. A public setting is an independent insurance specialist who a person can hire to pay an insurance claim.

The problem in these cases is that the homeowners claim that the public setting has taken their money.

Cary homeowner Dave Perez and his wife Jane contacted their insurance company after noticing a Dalksleck in their house.

“We still have to do with the insurance company … You said that 3,000 US dollars to fix this to patch this small area,” Dave told Troubleshooter Diane Wilson.

The couple said it had a lot more harm than that and said their roofer, BGC expert entrepreneur, recommended a public setting to help with their claim.

“Whenever an assertion is rejected, if we feel that there are storm damage, we would include a public setting because we as contractors are not allowed to discuss guidelines,” said Lauren Garlock from BGC. “So we would have to bring someone to the guideline, look at their policy and help to assist the insurance claim.”

Garlock said they recommended the public provider Tyler Englin from TDE Claims LLC.

As soon as TDE was deployed, Perez's insurance claim increased to more than $ 100,000.

“Most of it was in the roof and then was the rest of the interior, they know, repairs, and they know that the kitchen had to be renewed,” said Dave.

BGC did the whole work, and the Perez said they were, everything was fine until they heard from BGC, who said they were not paid for the work.

The Perez called its insurance company, which presented records that showed that they issued two checks for the claims. A check for more than 51,000 US dollars, the other for more than 47,000 US dollars.

“You can see where our signatures were forged. Jane does not even write out her name; it's more like a cancer.

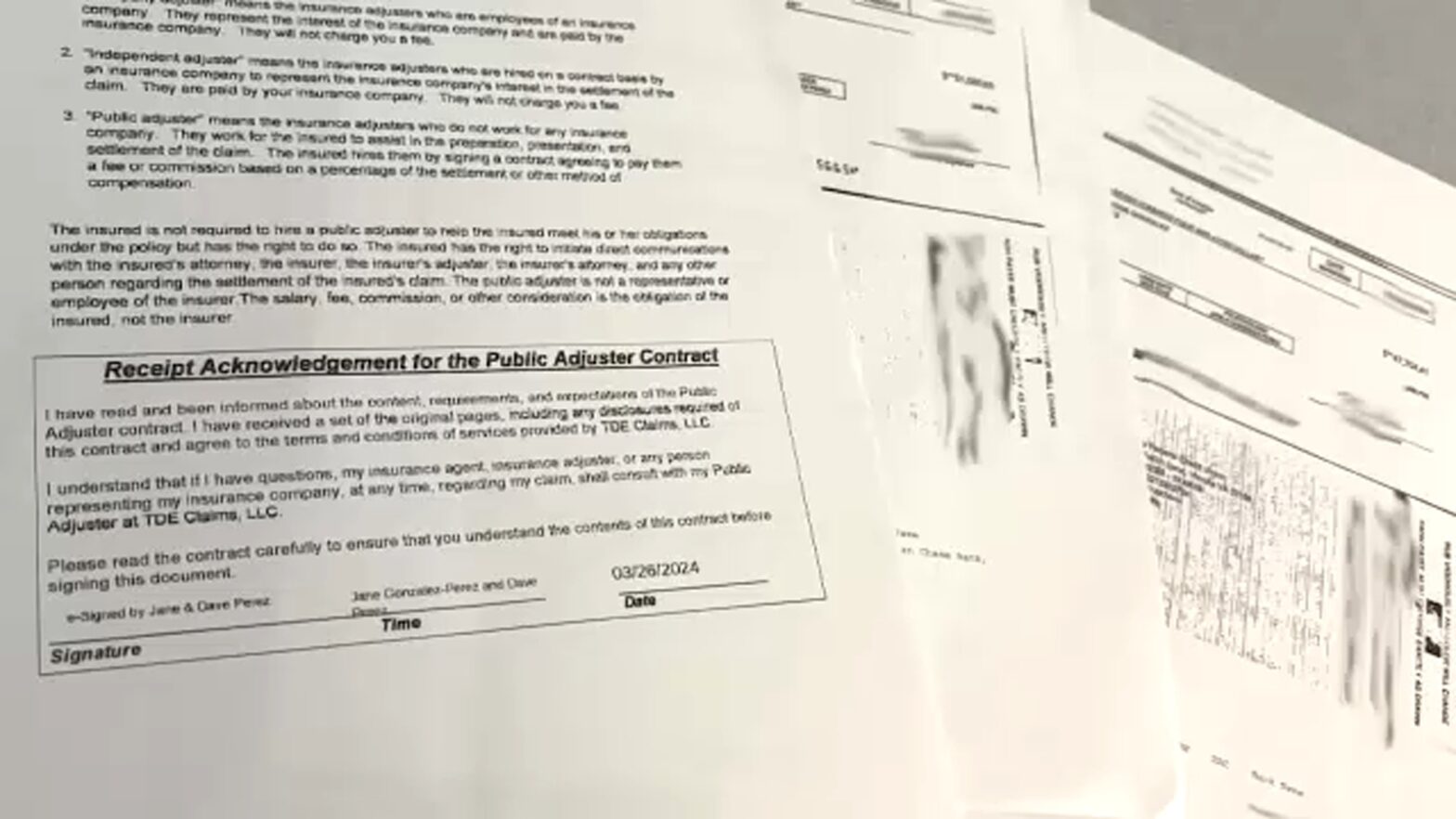

The Perez asked their insurance company why they sent English from TDE the checks and not them. The company informed the family that they had received a contract in which the e-signatures of the Perez had the adjuster hired.

Dave said his insurance said to him: “As soon as we got this from an expert, we will no longer deal with them at that time. We are dealing with him.”

Perez's claim that they have never signed this, and they do not sign the back of the checks from their insurance company.

“I think it's pretty obvious that they canceled checks who were forged,” said Dave. “Then you have a contract that we did not sign. And you have a contractor who is $ 100,000.”

Garlock with BGC said English with TDE promised payment for the completed work, but it didn't happen.

“Just excuse,” he said. “You will say:” Oh, I have set up a check in the mail “, and then we will never get it. He will say:” Oh, I'm not in the city. “And then you know, we'll meet you at some point. We live here. And once one of our employees went to his house, sat in his entrance, finally got a check and the check crashed.”

Overall, Garlock said that for three jobs for homeowners, in which English was the public setting with TDE, she was owed to around $ 120,000.

“It affects our business. We are small, we are local, a mother and a pop, you know, a general contractor. So you know that it is difficult not to be able to be paid for a year for a year,” added Garlock.

Garlock and Perez submitted complaints to the North Carolina Ministry of Insurance. A representative said:

“The Ministry of Insurance has received several consumer complaints in relation to Tyler Englin, a licensed public setting and also against TDE claims. The department is currently examining these symptoms.”

Troubleshoot Diane Wilson tried to get answers from England in various types, but was unsuccessful.

The website for TDE no longer works, and when ABC11 called, it is temporarily not available. There was also no response to several e -mails and texts.

As for the Perez, Dave said that he was concerned that Engin, if he could not be responsible for paying the contractor, if he did not work for the work that you did in his house.

“There is nothing that protects the homeowner from an adjuster,” he said.

In addition to the Perez, Diane Wilson's troubleshoot also heard from a homeowner in Holly Springs who hired English with TDE claims. There is evidence that the public adapter received the insurance allowance, and while TDE gave the homeowner a check for the amount he owed to pay the contractor, the check bounced off.

When it comes to a public setting, you should make sure that you are licensed in North Carolina. Also pay something in advance because the public directories receive a percentage of the insurance money.

Always make sure that the check is delivered to both you and the public setting, and of course read the small print before you sign something.

Also see ABC price -tracker: Check the regional prices for food, supply companies, living space and gas

All people involved said they followed these tips, but that still happened.

Copyright © 2025 WTVD TV. All rights reserved.