A statewide tax incentive could provide historic homeowners with property tax breaks, architectural historian Susan Benjamin told the city's Preservation Commission Tuesday night.

The tax break has similarities to a recently passed program that offers developers tax breaks that make 20% of units in a new project affordable.

But the tax credit for historic preservation has been around for a long time. This freezes the property's current assessed value for eight years, with incremental increases over three additional years, giving homeowners 11 years of benefits before having to pay the higher tax rate based on improvements made to the property.

For historic homes to qualify, Benjamin said they must be a local landmark listed on the National Historic Register or a “contributing building in a historic district.”

Homeowners must spend at least 25% of the home's assessed value on renovations or improvements, Benjamin said. This could include window or roof repairs, kitchen and bathroom renovations, internal electrical upgrades, and virtually anything that does not affect the historic fabric or features of the home.

The work must be completed within a 24-month period, but Benjamin said work completed before the application could be considered.

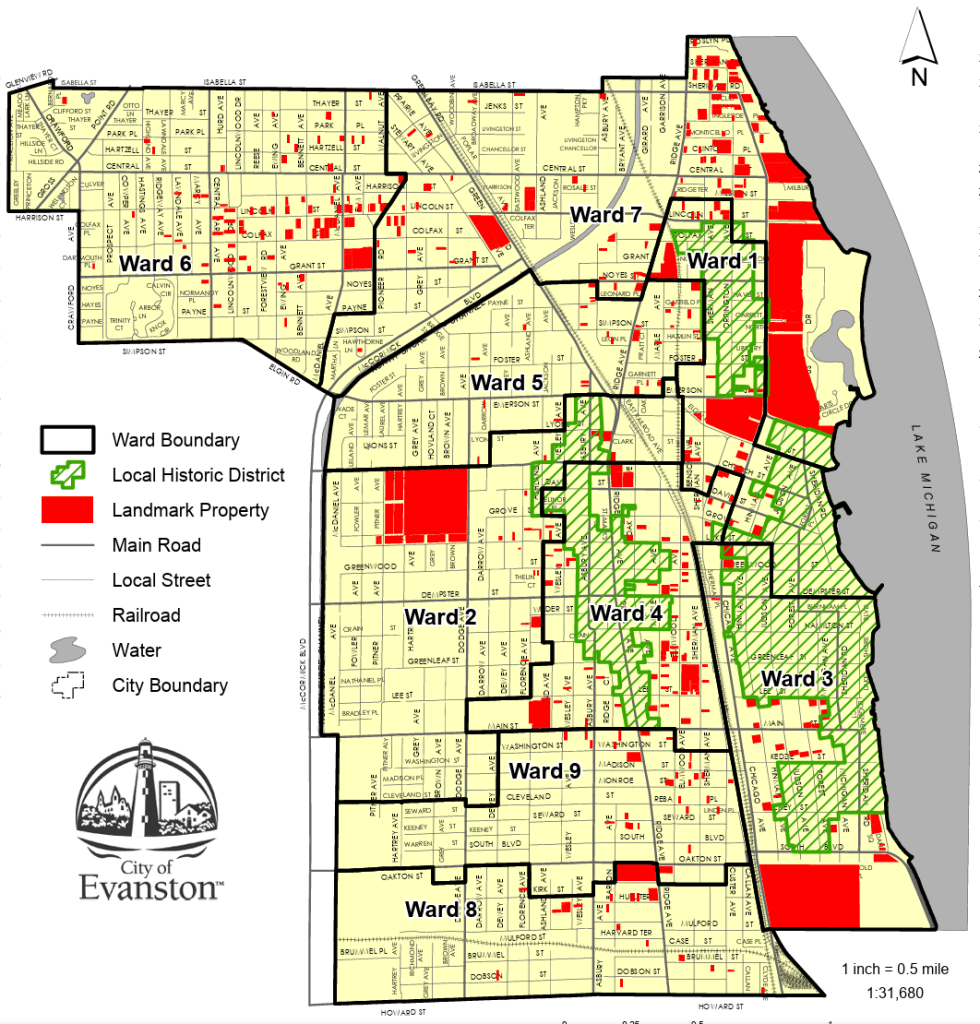

Benjamin said Evanston's 1,892 homes in historic districts and the city's more than 850 local landmarks could qualify.

Further information on how to apply can be found on the Secretary of State's website under the Historic Preservation Division.

Condominiums and cooperative buildings are also eligible, Benjamin said, as are apartment buildings with up to six apartments, as long as the building owner lives in one of the units.