Cambridge, mass. – According to the improvement of America's Housing 2025, a new report by the Harvard Joint Center for Housing Studies, the US redesign market rose over $ 600 billion after the pandemic and, despite the recent softening of 50 percent, remains above the pre-pandemic level.

Industry fragmentation, inflation and a lack of qualified trade, however, endanger the ability of the industry to fully satisfy demand. The strength of the redesign market was supported by the aging of houses and households as well as record values, but far more investments are required to satisfy the growing need for energy efficiency and disaster resilience from the country's 145 million houses.

Important snack bars from the report:

-

The pandemic drove unprecedented expenses for the conversion.

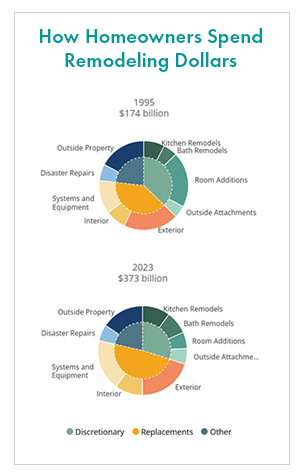

The improvement of the home improvement and repair of $ 404 billion in 2019 to $ 611 billion in 2022 and will probably remain over 600 billion dollars by 2025. The homeowners continue to focus on replacement projects such as roof bonds, windows and windows and HVAC, HLY -BOLING, 49 percent of improvements in 2023. 2007.

-

-

Climate change requires improvement expenses and increases the insurance premiums.

The growing frequency and intensity of danger events such as hurricanes, forest fires and floods increased the expenses for disaster repairs in 2022-2023 to 49 billion US dollars, an amazing leap of $ 16 billion from 2002 to 2003. While only a few homeowners carry out reduction negotiations, the premiums for increasing insurance may motivate: the average premium for homeowners insurance rose by 17 percent between 2021 and 2023. In 2023, homeowners also spent $ 139 billion for improvements that affect improvements. Costs ”, says Carlos Martín, director of the Remodeling Future program in the center.

-

The housing stock is older than ever and inferior conditions must be tackled.

With an average age of 44 years in 2023, the housing stock is older than ever, and critical improvements are required to replace the aging components. In 2023, the average improvement expenditure for houses that were built before 1980 was 24 percent higher than the houses built since 2010, and the maintenance expenditure was 76 percent higher. Many homeowners with low income live in living space with structural defects or without basic features such as flowing water, electricity or heat. “There is both a market chance and a moral imperative to expand improvement and repair services for these homeowners,” says Sophia Wedeen, Senior Research Analyst in the center. “Further financing instruments and consulting programs can also help to maintain the affordable housing stock and ensure that all households live in safe and appropriate apartments.”

-

The change in demography affects the conversion editions.

The shift features of the US households continue to change activity and expenditure patterns in the redesign market. In 2023, the owners wore 65 years old and over 27 percent of the total improvement spending, compared to 14 percent two decades earlier. And since the population becomes more racist and ethnically diverse, households, which are led by a colored person, contribute more to the DIY. In 2023, homeowners of color owners made 23 percent of improvement expenses, compared to 14 percent in 2003. Immigrants also make up a growing market share, from 8 percent of expenditure in 2003 to 13 percent in 2023.

-

Fragmentation, ascent costs and labor shortages hinder conversions.

Despite a flood of mergers and acquisitions, the conversion industry still remains strongly fragmented with large stocks of independent and small salary accounting companies. The industry is also disabled by high costs for building materials and workers. Between 2015 and 2023, the majority of the converter reported a lack of specialists, including carpenters, electricians and plumber. The industry is also very leaning on workers born abroad, with immigrants making a record organizer of 34 percent of the buildings in 2023.

-

Material shortages and high costs remain.

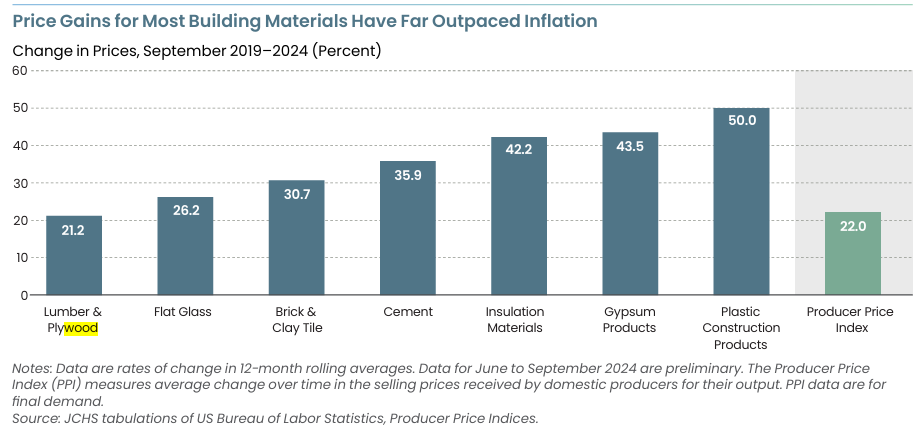

Although the annual growth of building material prices has largely slowed down or even negative since 2022, since the demand has cooled and the bottlenecks have decreased, the costs for many key materials are still significantly higher than the pre -pandemic level. The price

In the third quarter of 2024, wood and plywood was still 21 percent higher than in 2019, although he decreased for almost two years compared to the previous year.

In the short term, the renovation industry is both challenges and opportunities. On the one hand, increased interest rates, weak home sales and a persistent lack of qualified trading work are expected to restrict the market. At the same time, a massive level of equity, a continued shift in the work from home and the aging of the housing stock will support significant investments in improving your own home, possibly especially among owners who prioritize the update of their existing houses.

“In view of the strong basis and the growing need, the conversion of residential buildings will probably remain an impressive economic sector in the coming years,” says Chris Herbert, Managing Director of the Center. “And despite unprecedented expenses in recent years, a lot more investments are required to improve energy efficiency, the resistance of the disasters and the accessibility for the country's 145 million houses.”

To read the full report, visit Jchs.Harvard.edu.