April 24, 2025

Indexbox has just published a new report: US windows or wall climate systems, self -contained or shared systems – market analysis, forecast, size, trends and findings.

Driven by the demand from consumers, the market for self -contained or divided systems in the USA is located in the upward consumption. It is predicted that a composite annual growth rate of +1.1% and a value of +1.2% from 2024 to 2035 and 11 million units or 1.9 billion US dollars reached by the end of 2035.

Market forecast

Driven by increasing demand for window or wall climate systems, self-contained or shared systems in the USA, the market will probably continue an upward consumption trend in the next decade. The market performance is forecast to maintain its current trend pattern and to expand with an expected CAGR from +1.1% for the period from 2024 to 2035, which is expected to bring 11 million units to 11 million units by the end of 2035.

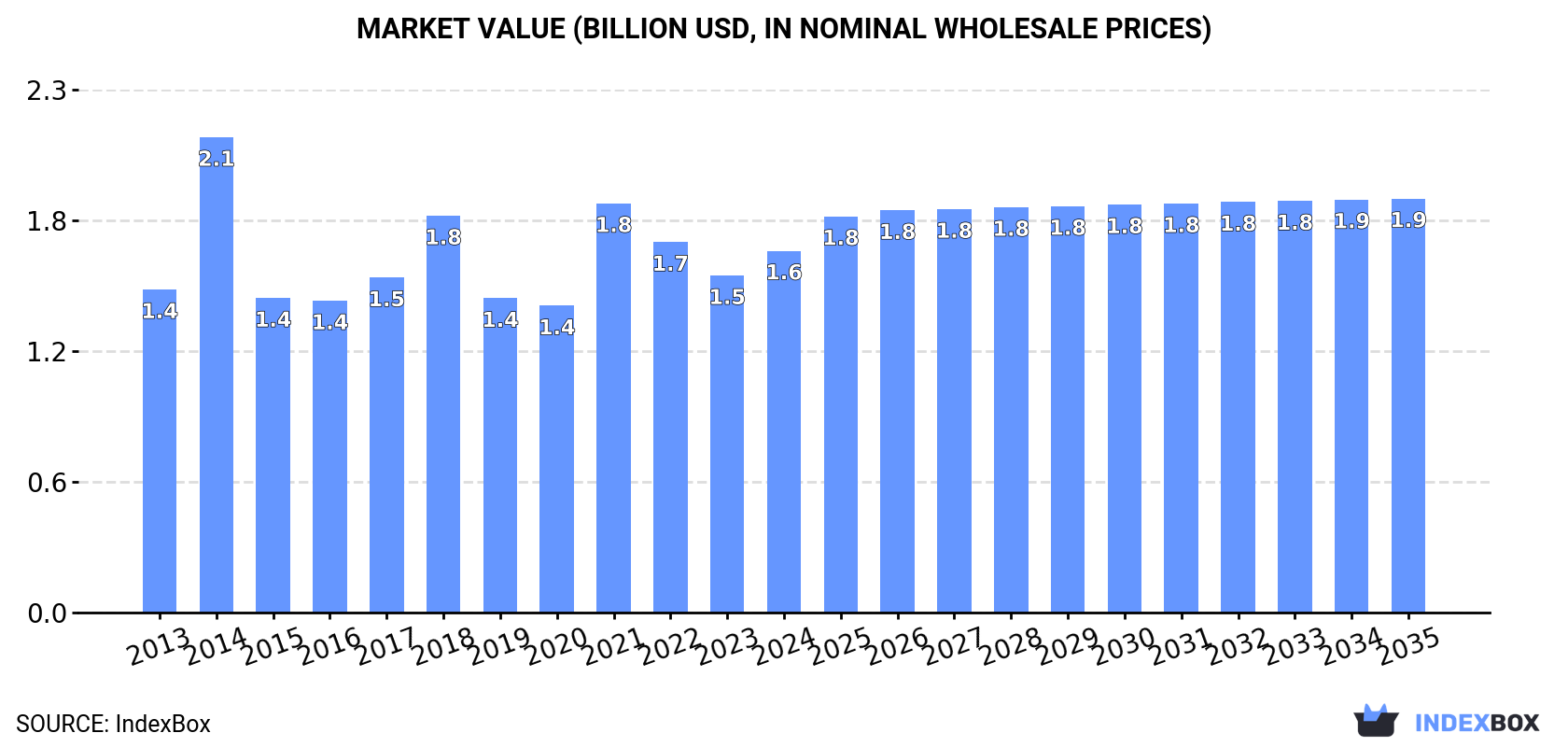

With regard to the value, the market is predicted with an expected CAGR from +1.2% for the period from 2024 to 2035, which is expected to give USD 1.9 billion (to nominal wholesale prices) by the end of 2035.

consumption

The consumption of window or wall climate systems in the USA, self-contained or shared systems

In 2024, the consumption of window or wall air conditioning systems, self-contained or divided systems was finally 9.3 m after two years of decline. During the checked period, the consumption continues to show a relatively flat trend pattern. As a result, consumption reached the peak volume of 11 million units. From 2022 to 2024, the growth of consumption remained in a slightly lower number.

The size of the market for window or wall climate systems, self-contained or shared systems in the USA rose considerably to USD 1.6 billion in 2024 and grew by 7.3%compared to the previous year. This number reflects the total income of manufacturers and importers (without logistics costs, retail marketing costs and retail margins that are included in the final consumer price). The market value rose from 2013 to 2024 by average annual rate of +1.0%; However, the trend pattern showed that some remarkable fluctuations were recorded during the analyzed period. As a result, consumption reached the peak of $ 2.1 billion. From 2015 to 2024, the growth of the market remained in a lower number.

production

The production of window or wall climate systems of the United States, self-contained or shared systems

After three years of growth, the production of window or wall climate systems in 2024 took over -2.7% to 1.9 m and generally fell by -2.7% to 1.9 m. In general, production recorded a drastic downturn. As part of the checked period, the production of peak volume achieved 4.9 million units in 2014; From 2015 to 2024, however, production could not be declined to dynamics.

In value reasons, the production of window or wall climate systems, in specially layered or divided systems in 2024 rose to USD 1.4 billion. Overall, the production recorded a noticeable shrinking. As part of the checking period, the production of the maximum level of $ 2.1 billion reached in 2014. However, production remained in a lower number from 2015 to 2024.

Imports

The import of window or wall climate systems of the United States, self-contained or shared systems

In 2024, the purchases of window or wall climate systems in overseas, independent or shared systems finally rose to 7.6 million units after two years of decline. Overall, however, imports saw a slight setback. The best -known growth rate was recorded in 2015 when imports rose by 117%. As part of the checking period in 2021, Hit Record Highs imported at 12 million units; From 2022 to 2024, however, imports were in a slightly lower illustration.

In terms of value, the import of window or wall climate systems, in which, self-contained or divided systems were $ 1.3 billion in 2024. In general, imports generally recorded a slight decline. The best known growth rate was recorded in 2021 with an increase of 34% compared to the previous year. In 2018, imports reached a highlight of USD 1.7 billion. From 2019 to 2024, however, imports could not get back in dynamics.

Imports by country

China (4m units), Thailand (2.9 million units) and Indonesia (498,000 units) were the main providers of imports of window or wall climate systems, in which the United States contained closed or shared systems with a compiled proportion of 97% of total imports.

From 2013 to 2024, Indonesia (with a CAGR of +415.4%) achieved the most remarkable growth rate in relation to purchases from the main providers, while imports for the other managers recorded more modest growth substances.

In value creation conditions, China ($ 562 million), Thailand ($ 480 million) and Mexico ($ 86 million) were together, which was the largest window, wall or shared air conditioning supplier to the USA, which is 87% of total imports. Indonesia followed in these countries, which made another 4.6%.

Indonesia with a CAGR of +248.8%recorded the highest growth rates in relation to the value of imports in the checking period, while purchases for the other managers recorded more modest growth substances.

Import prices to land

In 2024, the average import price for window or wall air conditioning systems, into which, self-contained or divided systems amounted to $ 169 per unit with an increase of 9.6% compared to the previous year. In general, the import price showed a relatively flat trend pattern. The growth pace was the fastest in 2014 when the average import price rose by 157%. As a result, the import price reached the top level of $ 425 per unit. From 2015 to 2024 the average import prices remained in a slightly lower number.

The prices varied noticeably from the country of origin: In the middle of the top importers, the country was Mexico (697 USD per unit), while the price of Indonesia ($ 120 per unit) was at the lowest.

From 2013 to 2024, Mexico (+2.8%) achieved the most remarkable growth rate, while the prices for the other large suppliers recorded a decline.

Export

The exports of window or wall climate systems of the United States, self-contained or shared systems

In 2024, the programs abroad took away from -15.1% to 245,000 units with window or wall climate systems, contained or shared systems and fell into the second year after two years of growth. In general, exports saw a pronounced cut. The best -known growth rate was recorded in 2014 when exports rose by 30% compared to the previous year. As a result, exports reached the climax of 437,000 units. From 2015 to 2024, the growth of exports of exports could not get back in the dynamics.

In value reasons, the exports of window or wall climate systems, self-contained or divided systems in 2024 increased significantly to $ 194 million. From 2013 to 2024, the entire exports showed a modest increase in the past eleven years. However, the trend pattern showed that some noticeable fluctuations were recorded during the analyzed period. Based on the figures from 2024, exports rose by +43.1%compared to 2020 indices. The growth pace seemed to be the fastest in 2022 when exports rose by 26% compared to the previous year. As part of the checking period, the exports of 2024 reached the top value and are likely to have a steady growth in the immediate term.

Exports to land

Canada (119,000 units) was the main goal for exports of window or wall climate systems, independent or divided systems from the USA, with a share of 49% to total exports. In addition, the exports of window or wall climate systems, which are summarized or shared systems to Canada in Canada, exceeded the volume that was sent four times to the second main goal, Mexico (27,000 units). The third position in this rank was held by Saudi Arabia (12,000 units) with a share of 4.8%.

From 2013 to 2024, the average annual growth rate in relation to the volume according to Canada was -3.6%. Exports to the other main destinations recorded the following average annual export rates: Mexico (+0.1% per year) and Saudi Arabia (+4.0% per year).

In value creation, Canada ($ 96 million) remains the most important foreign market for window or wall climate systems, independent or shared systems from the USA, which makes up for 50% of total exports. The second position in the ranking was taken over by Mexico ($ 25 million) with a share of 13% to total exports. Saudi Arabia followed with a share of 3%.

From 2013 to 2024, the average annual value growth rate for Canada was +2.7%. Exports to the other main destinations recorded the following average annual export rates: Mexico (+5.5% per year) and Saudi Arabia (-0.4% per year).

Export prices to land

In 2024, the average export price for window or wall climate systems, in which the self-contained or divided systems was 792 USD per unit, was 30% compared to the previous year. In general, the export prize showed a measured expansion from 2013 to 2024: The price rose by average annual rate of +4.3%in the past eleven years. However, the trend pattern showed that some noticeable fluctuations were recorded during the analyzed period. Based on the illustrations of 2024, the export price for window or wall air conditioning systems, self-contained or shared systems rose by +47.4% compared to 2020 indices. The best -known growth rate was recorded in 2015 an increase of 32% compared to the previous year. The export prize reached its peak in 2024 and is likely to have a steady growth in the coming years.

There were significant differences in the average prices for the most important export markets. In 2024, the country with the highest price was the Dominican Republic (USD 1.2,000 per unit), while the average price for exports to Brazil ($ 463 per unit) was at the lowest.

From 2013 to 2024, the most remarkable growth rate in relation to the prices for supply to Kazakhstan (+12.5%) was recorded, while prices for the other main destinations recorded more modest growth substances.

Source: Indexbox Market Intelligence Platform