Key insights

- Honeywell's building automation segment reported organic revenue growth of 8% in the second quarter of 2025.

- Construction products sales increased 9% due to demand for robust fire protection, security and management systems.

- Bookings increased for the fifth consecutive quarter, driven by robust global project activity.

Honeywell International Inc. (HON – Free report) is benefiting from strong momentum in its building automation segment, which is becoming a key growth driver for the company. Solid demand for its products and solutions, led by increasing construction projects, particularly in North America, the Middle East and India, supports the segment's revenue. The increasing number of orders in data centers, airports and catering projects are also a good sign. The segment's organic sales increased 8% year-over-year in the second quarter of 2025.

In the building automation segment, organic sales of the building products business increased 9% year-over-year in the second quarter, driven by strong demand for fire protection, security and building management systems. During the same period, building solutions business revenue also grew 5% year-on-year, supported by solid growth in the Middle East region.

Honeywell's building automation segment experienced good order activity in the quarter, with orders increasing both sequentially and year-over-year, driven by strong product demand. This was the fifth consecutive quarter in which the segment experienced year-over-year order growth, driven by continued customer demand and robust market conditions.

Going forward, Honeywell expects continued strength in the building automation segment, supported by increasing demand for energy efficient infrastructure and digital building management systems. In 2025, HON expects the segment's organic sales to increase in the mid to high single digits. Additionally, both the building products and building solutions businesses show steady momentum, positioning the segment for future growth.

Segment snapshot of the HON colleagues

HON's most important competitors include: 3M company (MMM – Free Report) is poised to benefit from solid momentum in the safety and industrial segment, driven by strength in the personal safety, roofing granules, industrial adhesives and tapes, abrasives and electrical markets. Stable demand for 3M's electrical infrastructure products such as medium-voltage cable accessories and insulating tapes bodes well for the segment in the coming quarters. 3M's Security and Industrial segment revenue increased 3.6% year-over-year in the second quarter of 2025.

Honeywell is another colleague, Carlisle Companies Incorporated'S (CSL – (Free Report) The Carlisle Construction Materials segment is benefiting from robust demand for roof restoration products and good construction activity. Higher sales in the non-residential construction market in the United States and Europe also bode well for the Carlisle segment. The Carlisle unit's revenue rose 0.6% year-on-year in the second quarter of 2025.

Price history, valuation and estimates of HON

Honeywell shares have gained 0.4% over the past six months, compared with the industry's growth of 2.8%.

Image source: Zacks Investment Research

From a valuation perspective, HON trades at a forward price-to-earnings ratio of 17.94x, which is higher than the industry average of 11.03x. Honeywell has a Value Score of D.

Image source: Zacks Investment Research

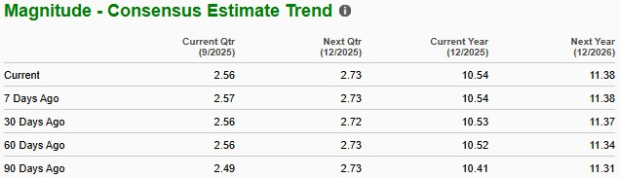

The Zacks Consensus Estimate for HON's 2025 earnings has increased 0.2% over the past 60 days.

Image source: Zacks Investment Research

Honeywell currently has a Zacks Rank #3 (Hold). You can see You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.